An asset would have the prefix of 1 and an expense would have a prefix of 5. This structure can avoid confusion in the bookkeeper process and ensure the proper account is selected when recording transactions. The balance sheet accounts give a snapshot of the business on any given date. This column shows the financial statement in which the account appears, and for a profit making business is either the balance sheet of the income statement. Unique numbers assigned to accounts enable easy identification and classification.

Cash Flow Statement

Additionally, you can adjust the chart to better suit your needs by adding specific accounts. Notice how each account is classified as balance sheet or income statement and then further classified into a group such as for example accounts receivable. The account names will depend on your type of business, but the classification and grouping should be similar to the table above. More complex entities may have longer account codes to accommodate the reporting needs of the entity.

What is a chart of accounts and how to set one up [examples included]

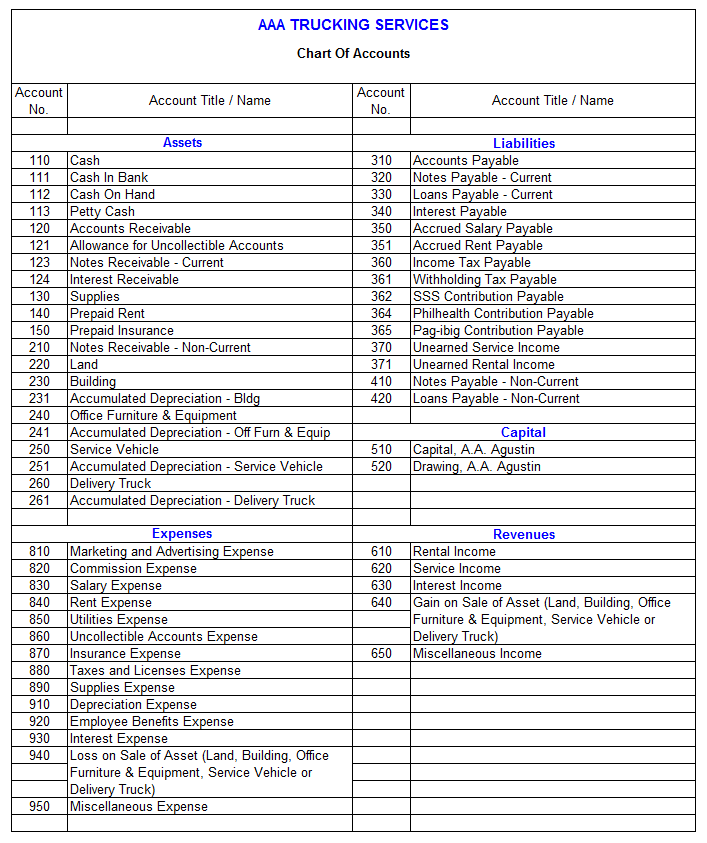

Many organizations structure their COAs so that expense information is separately compiled by department. Thus, the sales department, engineering department, and accounting department all have the same set of expense accounts. Examples of expense accounts include the cost of goods sold (COGS), depreciation expense, utility expense, and wages expense. Traditionally, each account in the COA is numbered, and accountants can quickly identify its type by the first digit. For example, asset accounts for larger businesses are generally numbered 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299).

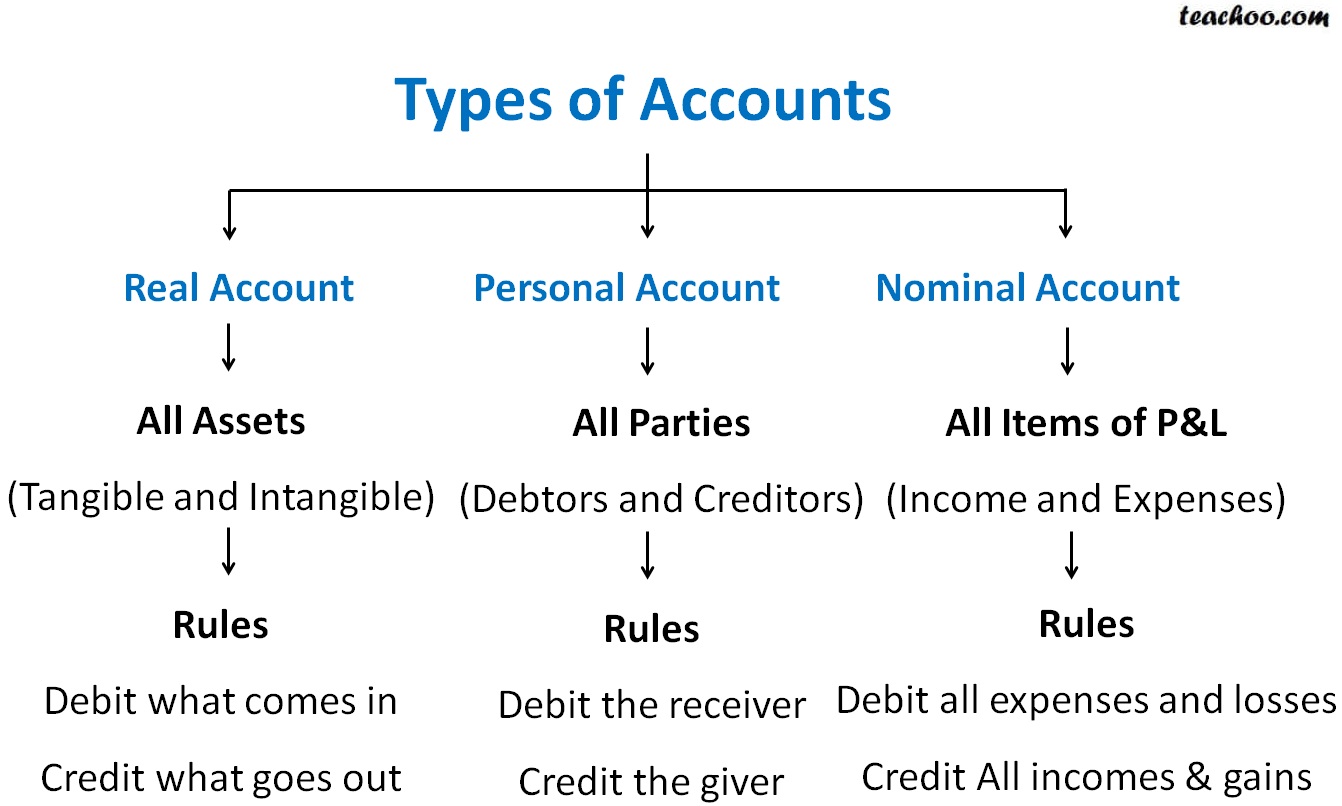

- For example, if a company makes a sale, it debits an asset account (like Accounts Receivable or Cash) and credits a revenue account (Sales Revenue), as defined in the COA.

- Assets represent what a company owns, liabilities represent what a company owes, and owners’ equity represents the shareholders’ investment.

- A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period.

- It provides a detailed framework for analyzing past transactions, invaluable for projecting future financial performance.

Great! The Financial Professional Will Get Back To You Soon.

In the sample chart of accounts for example, the expense accounts are sub-divided into business functions such as research and development, sales and marketing, and general and administrative expenses. Accounts are classified into assets, liabilities, capital, income, and expenses; and each is given a unique account number. Here is an example of a company’s cash accounts being combined for presentation in the financial statements. With real-time reporting capabilities, AP automation solutions provide immediate access to financial data, facilitating quick and informed decision-making. They also support compliance efforts by keeping up with the latest accounting standards and tax laws.

All Categories

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. For example, bank fees and rent expenses might be account names you use. Consider creating separate line items in your chart of accounts for different types of income. Instead of lumping all your income into one account, assess your various profitable activities and sort them by income type. The chart of accounts streamlines various asset accounts by organizing them into line items so that you can track multiple components easily. Changes – It’s inevitable that you will need to add accounts to your chart in the future, but don’t drastically change the numbering structure and total number of accounts in the future.

COA Structure

Non-current assets, also known as fixed assets, are utilized over a more extended period and are typically not considered quickly convertible into cash. These assets play a pivotal role in a company’s long-term financial health and growth potential. Investment in non-current assets reflects a commitment to future business sustainability and efficiency, as they are used in the production of goods, supply of services, or for rental to others. As part of the equity accounts, retained earnings serve as an indicator of the company’s financial health and its capacity to generate profits for continued growth. By closely monitoring retained earnings alongside shareholders’ equity, businesses can make informed financial decisions that enhance shareholder value and long-term sustainability. Equity accounts are a crucial component of a company’s chart of accounts as they represent the owners’ interest in the assets of the business.

The accounts list may also include codes you do not require but are worth keeping for future use. Before you start, it’s important to keep in mind that your chart of accounts should reflect the unique financial needs and structure of your business. You should also consider the future growth and potential changes to the COA. As such, it’s essential to have a clear understanding of the company’s financial transactions and how they should be classified. For example, under the asset category, businesses may have subcategories such as cash, investments, inventory, accounts receivable, etc.

Let’s say that in the middle of the year Doris realizes her orthodontics business is spending a lot more money on plaster, because her new hire keeps getting the water to powder ratio wrong when mixing it. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. We provide third-party links as a convenience and for informational purposes only.

For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts. Keeping an updated COA on hand will provide a good overview of your business’s financial health in a sharable format you can send to potential investors and shareholders. It also helps payroll software your accounting team keep track of financial statements, monitor business financial performance, and see where the money comes from and goes, making it an important piece for financial reporting. Small businesses use the COA to organize all the intricate details of their company finances into an accessible format.

However, a profit and loss (P&L) statement overviews revenues and expenses. Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging. Angela Boxwell, MAAT, is an accounting and finance expert with over 30 years of experience. She founded Business Accounting Basics, where she provides free advice and resources to small businesses.